Claims Operations, Standardized and Audit-Ready.

Ensure every claim—intake, investigation, evaluation, and settlement—follows consistent, compliant procedures.

Replace manual documentation, inconsistent adjuster workflows, and audit risk with standardized checklists and defensible records.

Built for claims operations teams that must prove consistency—not just hope for it.

Common Claims Management Challenges

Claims intake varies by adjuster, creating inconsistent documentation and avoidable E&O exposure.

Investigation steps get skipped or delayed, leading to SLA failures and client dissatisfaction.

Field inspections lack standardized photo requirements and structured damage documentation.

Critical documents are scattered across emails, PDFs, and shared drives—difficult to audit or verify.

Supervisors have limited visibility into adjuster productivity and processing cycle time.

Compliance teams struggle to prove that procedures were followed across every claim file.

How ScaleWyz Helps Claims Operations

Standardize Claims Workflows

Create repeatable FNOL, investigation, documentation, and settlement procedures with step-by-step checklists and required evidence capture.

Track Every Deadline & SLA

Manage statutory timelines, follow-ups, required communications, and diary notes with automated reminders that prevent SLA failures.

Field Documentation Compliance

Ensure inspectors capture required photos, statements, damage evaluations, and location metadata on every assignment.

Compliance-Ready Audit Trails

Generate defensible, automated documentation for every step taken on a claim file—reducing E&O exposure and audit failures.

Claims Performance Visibility

See adjuster reliability, completion patterns, bottlenecks, and cycle time metrics from actual claim workflows.

Key Workflows for Claims Operations

From first notice of loss to final settlement—ScaleWyz supports the workflows your adjusters run every day.

First Notice of Loss (FNOL)

Complete intake with required claim details and documentation.

Coverage Verification

Policy review checklist with coverage analysis steps.

Field Inspection

On-site assessment with photo documentation requirements.

Damage Evaluation

Structured estimate review and approval workflow.

Communication Log

Contact tracking with required touchpoint documentation.

Subrogation Review

Recovery potential assessment and pursuit tracking.

Settlement Processing

Payment authorization and closure documentation.

Compliance Audit

Post-close quality review and procedure verification.

QR code-triggered checklists work on any phone—no app download required.

See It in Action

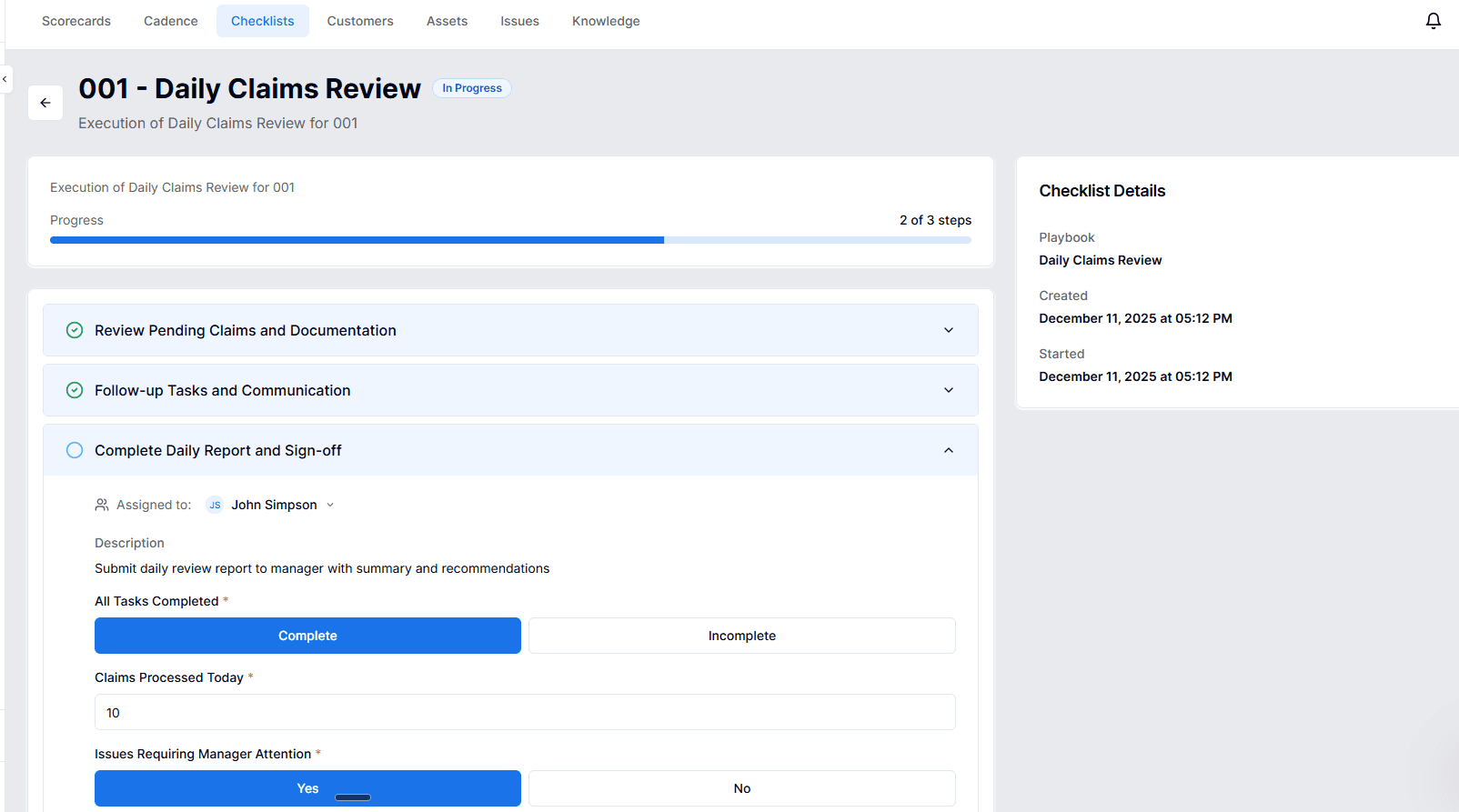

A closer look at how claims teams use ScaleWyz to ensure consistently documented, defensible claim files.

Field Inspection Checklist

Adjusters complete standardized field inspections with required checkpoints that ensure every claim file is complete and defensible.

- Capture all required photos (damage, source, surroundings, identifying details)

- Collect on-site statements with timestamp and geolocation

- Input measurements, estimates, and severity scoring

- Complete hazard and fraud indicators as required

- Generate standardized documentation for supervisor review

Audit-Proof Documentation

Every checklist completion generates timestamped, location-tagged, immutable records. When auditors or attorneys ask "can you prove this was done?"—you can.

The Solution Stack

ScaleWyz apps configured for claims management operations

Checklists

FNOL intake, field inspections, damage evaluation, and settlement workflows—standardized with required evidence at each step.

Cadence

Statutory deadlines, follow-ups, diary notes, and SLA commitments that never get missed.

Knowledge

Policy guides, coverage memos, investigative standards, and compliance requirements in one searchable location.

Customers

Insured parties, claimants, and third parties with claim history, communication logs, and activity documentation.

Assets

Track insured properties, vehicles, and equipment with QR-linked inspection histories.

Scorecards

Cycle time, completion reliability, and SLA adherence metrics from actual claims processing data.

Why Claims Teams Choose ScaleWyz

Reduce cycle times with standardized workflows and automated follow-ups

Ensure consistent handling regardless of which adjuster is assigned

Generate audit-ready documentation that meets compliance and E&O defense requirements

Mobile-first field tools that work on phones and tablets

Capture complete evidence sets without missing required documentation

See real-time performance metrics from actual claim workflows

Run Better Claims Operations.

Standardize claim handling, hit every deadline, defend every file with complete documentation, and ensure adjusters follow consistent, compliant procedures.

No setup time • No onboarding cost • Start improving your handling today